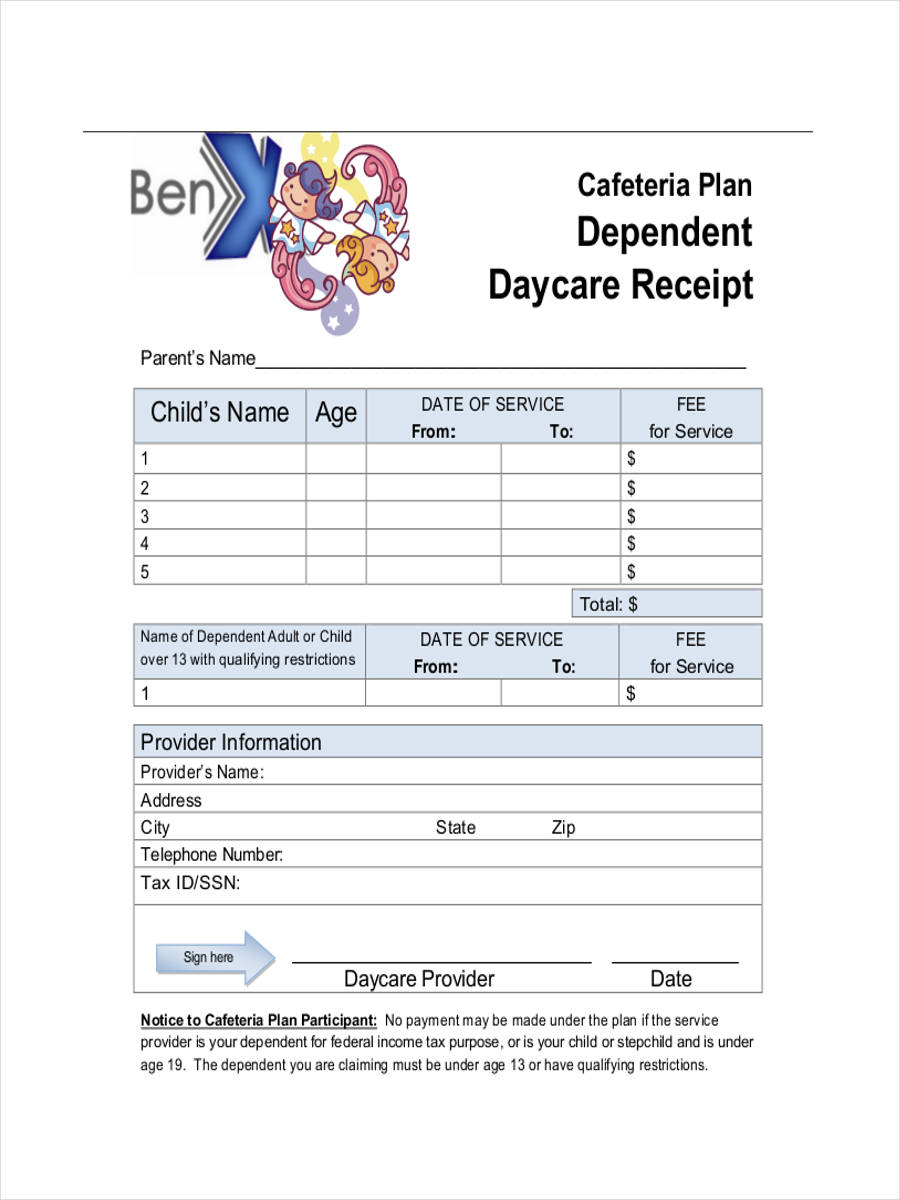

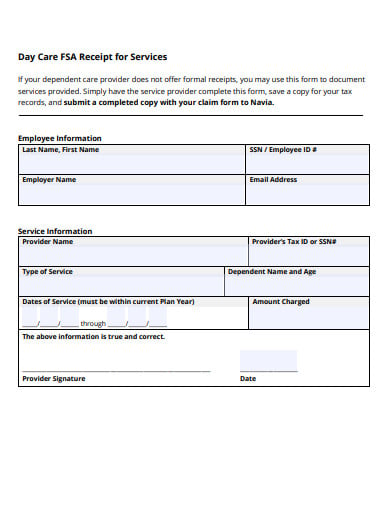

Parents or guardians who want to make a childcare expense deduction on their taxes are required to provide a receipt given to them by the individual or organization that received payment for the childcare service. Providing clients with the proper paperwork will allow them to receive tax deductions. (a) You are enrolled in an educational program that is offered by. However, if your spouse or common-law partner has the higher net income and one of the conditions below apply, he can make the claim for child care expenses at line 21400. Provide the Proper Paperwork for Childcare Expense Deduction for Clients Generally, the person with the lower net income (including zero income) must claim the child care expenses.

#CHILD CARE EXPENSES RECEIPT TEMPLATE SOFTWARE#

Join many other small business owners in using online invoicing software to track accounts receivables, create professional invoices, and document expenses. Child Care Receipt Template Blank Printable Pdf, Excel & Word (Pack of 5). This can help you build a better relationship with parents who appreciate a professional receipt.Ī free downloadable daycare invoice template saves you time and helps you track profits.

#CHILD CARE EXPENSES RECEIPT TEMPLATE VERIFICATION#

Generally it is a documented verification that goods have been received or services which have been provided. Mark the bill “Paid in Full” towards the total, list the payment type, and date of payment. Dependent care fsa nanny receipt template, An acknowledgement of payment receipt is a business document of confirmation that serves as a formal endorsement of the payment thats usually created by the client, tenant of client. You can use your daycare invoice template as a receipt for parents after they pay the bill in full. You can use this information to account for your mileage claims. On the daycare invoice transportation line, show the distance from your business to the child’s school and the number of trips per week.

Our records reflect that the child lived at This helps you track profits from transportation and expenses so you can claim vehicle usage on your tax forms, even if the business owns a van or small bus. Our records show we provided service (s) to

This helps you track profits from transportation and expenses so you can claim vehicle usage on your tax forms, even if the business owns a van or small bus. Our records show we provided service (s) to List this fee as a separate line item on your daycare invoice. Do you pick up and drop off children at the local schools? If so, you will probably be charged a transportation fee.

0 kommentar(er)

0 kommentar(er)